El objetivo central de la reunión cumbre debe incluir a representantes de EU y Canadá para fortalecer cooperación económica y comercial y mejorar capacidad productiva y empleos dignos (trabajo decente señala la OIT en su lema actual).

Consolidar cooperación y mayores inversiones.- Esta iniciativa debe incluir a las empresas mexicanas con presencia en la región y motivar a más empresarios mexicanos, de EU y Canadá a invertir en la región para generar más empleos de calidad de manera que disminuya la tendencia a migrar, especialmente de jóvenes migrantes de Guatemala, Honduras y El Salvador.

Este esfuerzo de cooperación se puede canalizar vía Proyecto Mesoamérica y Tratado Único de Libre Comercio entre México y Centroamérica, ampliando facilidades para exportaciones de CA y fortalecer proyectos incluyendo infraestructuras carretera y portuaria.

México debe fortalecer cooperación triangular hacia estos tres países centroamericanos con Japón, Corea, EU, Canadá y Unión Europea. Existen antecedentes de cooperación triangular con Japón y España en varios países de la región. Un caso notorio en El Salvador y otros países de la región es la cooperación con Japón en construcción de viviendas antisísmicas.

Se puede explorar el fortalecimiento de la cooperación sur-sur con Colombia, Brasil y Chile que tienen ya presencia económica y financiera importante en la región. En esta cumbre regional se recomienda presencia de organizaciones de la ONU como PNUD, ONUDI, OIT, FAO, OPS, Fondo de Población, etc que tienen representaciones en la región.

Vale la pena señalar que México ya cuenta con espacios de cooperación en una gama amplia de proyectos en el marco de la cooperación iberoamericana con la Secretaria General Iberoamericana (segib.org). https://www.gob.mx/amexcid

Estos proyectos que han rendido frutos importantes en Centroamérica, el Caribe y Sudamérica pueden ser palancas firmes para consolidar el desarrollo regional y enfocar una parte clave del Fondo México para apoyar el desarrollo con equidad y sustentable de Centroamérica. https://www.segib.org/?document=mexico-en-la-cooperacion-iberoamericana-2

En relación a las empresas mexicanas grandes que tienen fuertes inversiones se puede hacer un compromiso de inversión y capacitación laboral para los próximos 5 años. México debe fortalecer la cooperación en caso de desastres naturales por la alta vulnerabilidad y riesgo en la región.

Más cooperación en seguridad regional.- En el ámbito de la seguridad y control de la delincuencia y crimen organizado se deben formular nuevos programas de cooperación evitando que EU tome el liderazgo aun considerando que la Escuela de entrenamiento policial de EU para Centroamérica y el Caribe tiene su sede en El Salvador. Un país europeo con fuerte presencia en la región en temas de cooperación es Alemania y se deben iniciar acercamientos con ese país. Recomiendo Artículo de Emb Agustin Getz Canet: http://www.milenio.com/opinion/agustin-gutierrez-canet/sin-ataduras/estrategia-de-mexico-en-centroamerica

Es relevante la inclusión de jóvenes centroamericanos en el programa @JovenesConstruyendoelfuturo para generar empleos para cerca de 15 millones de jóvenes de 18 a 29 de años a lo largo del sexenio 2018-2024. La Mtra Luisa María Alcalde será responsable de este Programa como futura secretaria de @STPS_MX lnkd.in/efDXQqj

América Sin Muros coincide con el Dr Sergio Aguayo en su artículo: "Éxodo y urnas" publicado el 24 de octubre 2018 que da mayor consistencia y urgencia al Plan de Cooperación de AMLO con Centroamérica: "En América Central la desigualdad es brutal, la violencia criminal impone sus reglas y los gobiernos se distinguen por su debilidad e impotencia. Ante ese contexto, resulta totalmente natural que una población desesperada responda al llamado de un activista hondureño para iniciar una marcha hacia Estados Unidos, lo cual implica cruzar el infierno mexicano."

Aguayo afirma que "en los últimos años, México detiene y deporta más centroamericanos que los EU, es evidente la ausencia de políticas que atiendan la raíz del problema. La propuesta de solución más sensata la planteó Andrés Manuel López Obrador en el debate presidencial realizado en Tijuana. En estos días ha vuelto a proponer que México, Estados Unidos y Canadá se unan para financiar el desarrollo de América Central y reducir, de esa manera, los factores de expulsión." Este Plan estará listo para el inicio del próximo gobierno.

Sin embargo, Sergio Aguayo puntualizó que "El planteamiento es sensato pero incompleto. Le falta ligarlo con la guerra contra el crimen organizado, porque las bandas criminales han convertido los desplazamientos de la población en arterias que alimentan sus arcas y ensanchan la base social del sicariato. Por cierto, las migraciones también alimentan la corrupción oficial."

Aguayo insiste que "hace falta una política de migración que armonice el combate al crimen organizado con una nueva relación hacia América Central y del Norte."

Aguayo reitera que en el nuevo gobierno "están obligados a coordinar estrechamente el trabajo de las Secretarías de Seguridad Pública y Relaciones Exteriores. Si lo logran, México tendría un enfoque innovador que le permitiría recuperar su liderazgo perdido. Con una política de ese tipo, podrá hablarse de que sí están atacando de raíz las causas de la migración, el crimen organizado y la corrupción." En nuestra opinión, deben ser más secretarías de estado y dependencias del gobierno federal que deberán de participar en el Plan de Cooperación con Centroamérica. No

----------------------------------------------------------------------------------------------------------------------------------------------------------------------

SecurityCornerMexico.com RECOMIENDA la Lectura de: Mexicanos en los EUA, IME y el Cometido del Servicio Exterior (SRE), Primeros Pasos del que Inicia un Negocio en Tucson, Arizona, EN INGLES: Expectations of the Summit on 4/21 & 22 in New Orleans: The SSPNA, The Border and the Ballot Box, The Valley of Cuatro Cienegas, in Central Coahuila, México, Mexicanos en los EUA, IME y el Cometido del Servicio Exterior (SRE) por Bernardo Méndez Lugo, miembro del Servicio Exterior Mexicano & Tucson, Arizona por Wikipedia

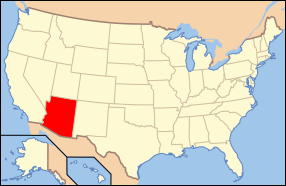

El Mercado Mexicano en Arizona

Por: Bernardo Mendez Lugo

Cónsul alterno de México en Tucson, Arizona

El impacto económico en la producción y el peso de los mexicanos en el dinamismo del mercado de consumo en Arizona y en amplias regiones de la Unión Americana no puede medirse en su verdadero significado por varios motivos. El más común, es el hecho de que más de seis millones y medio de mexicanos están en situación migratoria irregular, sin contar con permisos de trabajo. Pero también existen muchos mexicanos, e inmigrantes en general, que aun contando con estancia legal y todas las formalidades para trabajar legalmente, participan en un creciente mercado informal de trabajo, producción, servicios y consumo.

En este amplio mercado informal o paralelo confluyen el empleo por cuenta propia, las actividades de la empresa casera o familiar, el trueque de servicios que elimina la circulación monetaria, entre otros. No se trata de actividades ilícitas o prohibidas, simplemente son actividades donde resulta muy oneroso y lento el registrarse legalmente ante la autoridad gubernamental. De acuerdo con testimonios del empresario mexicano José Luís Tornero, que es un entrenador profesional para los nuevos emprendedores en Tucson, el tuvo que esperar mas de 12 meses para poder contar con todos los permisos para abrir un pequeño supermercado en el sur de Tucson.

Se puede afirmar que muchos sectores de la economía de Arizona pueden sobrevivir y en muchos casos competir a nivel regional, nacional e internacional gracias al trabajo de cientos de miles de nuevos inmigrantes y un número no despreciable de trabajadores indocumentados mexicanos que laboran en casi todos los rubros y su desempeño es vital para la economía de muchas regiones del estado. Arizona como estado fronterizo con Sonora, recibe anualmente un número significativo de inmigrantes procedentes de Sonora y en segundo lugar migrantes procedentes del estado de Sinaloa.

En Arizona se ha experimentado un crecimiento dramático de la población nacida en el extranjero que se ha establecido en el estado. Esto ha traído como consecuencia, un crecimiento de la población de Arizona mucho más alto que el promedio nacional de EU. En total, la población de Arizona se incrementó, en promedio, un 20.1% de 2000 a 2006, este crecimiento fue considerablemente mas alto que el incremento promedio de la población a nivel nacional que fue de 6.4% en el mismo periodo.

Como consumidores estos inmigrantes han incrementado significativamente el poder de compra de la economía arizonense. Este gasto realizado por los trabajadores inmigrantes también genera ingresos por impuestos.

El aporte que los mexicanos, legales e indocumentados, hicieron al gobierno del estado de Arizona, vía impuestos, superó los 800 millones de dólares en 2007, de acuerdo con estimaciones privadas. En ese mismo año, el poder adquisitivo de este grupo fue de 6,630 millones de dólares, uno de los más altos per capita, para comunidades mexicanas en Estados Unidos, reveló un estudio de la Universidad de Thunderbird.

Hablar de mercado Hispano en Arizona es hablar de mas de 80% de consumidores mexicanos o de origen mexicano, que alcanzó en 2007 un poco mas de 21 mil millones de dólares de capacidad de compra y se calcula que en 2009 alcance 31 mil millones de dólares.

Arizona es el noveno mercado hispano mas grande de los Estados Unidos de acuerdo a las estimaciones de Datos 2006, un estudio anual compilado por la Cámara Hispana de Comercio con sede en Phoenix, la Universidad Estatal de Arizona y Salt River Project.

Logo & Link by Wikipedia

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a U.S. registered 501(c)(3) tax-deductible nonprofit charity.

Los Hispanos son una cuarta parte de la población de Arizona, con un total de 1.6 millones de latinos, de los cuales medio millón aproximadamente son inmigrantes recientes, en su mayoría procedentes de México.

Es importante señalar que los consumidores latinos gastan más, en promedio, que los consumidores no-latinos en muchas categorías de consumo, como abarrotes y ropa para niños.

Algunos ejecutivos de mercadeo en Arizona indican que algunas de las áreas de crecimiento fuerte (hot growth áreas) de los consumidores latinos son los servicios de atención médica, vivienda residencial, servicios y productos financieros, artes y cultura.

Adicionalmente, la fotografía que surge de los hispanos o latinos, en estudios recientes en la creciente sobre la población latina, muestra perfiles radicalmente diferentes a la mayoría de los sectores no latinos.

Por ejemplo, los latinos cambian del uso del español al inglés con cada generación. Hacia la tercera generación, el inglés domina en el 75% de los latinos de Arizona, los cuales hablan únicamente inglés o son bilingües.

Las nuevas estadísticas muestran cambios que destruyen los antiguos estereotipos de los latinos, y demuestran su creciente influencia en el crecimiento de los negocios en Arizona a través de su poder de compra en conjunto. Estos cambios han estado influenciados principalmente por los siguientes factores:

- Inmigración de otros países, particularmente de México y Centroamérica.

- La media de edad en la población latina es mas baja que otros segmentos de población y los latinos también tienen altas tasas de natalidad.

- Un crecimiento de los ingresos de los latinos debido a mayores niveles de educación y preparación, incluyendo el mayor dominio del idioma inglés.

- Un proceso de continua aculturación y asimilación de las generaciones sucesivas de latinos.

Así mismo, es importante distinguir las diferencias entre los distintos segmentos de población con sangre mexicana en Arizona. La identidad es muy diferente entre el inmigrante reciente, el inmigrante indocumentado con varios años de radicar y trabajar en Arizona, el inmigrante que reside con visa pero no cuenta con permiso de trabajo, el inmigrante con residencia permanente, el inmigrante que se ha convertido en ciudadano y el no inmigrante que ha nacido en Estados Unidos, de origen mexicano, que tiene arraigo por varias generaciones en territorio arizonense y por lo tanto, estadounidense por nacimiento. Aunque todos estos segmentos guardan vínculos económicos, familiares, culturales y lingüísticos con México, su comportamiento y vinculación hacia este país tienen diferencias cualitativas; así como su arraigo a la vida y sociedad arizonense.

Las estadísticas también reflejan que los latinos están inmersos y bien integrados en todas las comunidades de Arizona en lugar de estar segregados o separados en barrios por idioma, geografía o perfil económico.

La realidad de hoy es que cuando se habla de cualquier aspecto de la sociedad de Arizona – sean negocios, política, educación, cuidados de salud – no se puede hacer sin tomar en cuenta el mercado hispano y su influencia.

Miembro del Servicio Exterior Mexicano desde el 23 de octubre, 2006. A la fecha se desempeña como Cónsul Alterno de México en Tucson, Arizona. Fué Cónsul de Prensa, Cónsul de Comercio y Promoción de Negocios en el Consulado General de México en San Francisco de agosto de 2001 a Octubre de 2006. Cónsul de Prensa y Asuntos Académicos en Atlanta (1996-2001) y Montreal (1992). Profesor-fundador de la División de Ciencias Sociales, UAM-Xochimilco y socio-fundador del Instituto Mexicano de Investigaciones Educativas, AC, con Gilberto Guevara Niebla en 1995. Posgrado en Planeación social y Educativa en Polonia y Maestría en Estudios del Desarrollo en la Universidad de Sussex en Gran Bretaña. Coautor de El Positivismo Mexicano, UAM-X, 1985, Educación y Cultura ante el TLC, Nueva Imagen-Fundación Nexos, 1992 y Las Costumbres Jurídicas de los Indígenas en México, CNDH, 1994. Publicó La Micro y Pequeña Empresa en México Frente a los Retos de la Globalización, México, CEMCA, 1995 y Sociedad y Derechos Indígenas en América Latina, CEMCA, 1995, de los cuales es coordinador editorial y coautor. Asesor/Consultor de Organización Panamericana de la Salud en Washington, D.C., Banco Mundial, Organización de Cooperación y Desarrollo Económico (OCDE), Fundación NEXOS, CANACINTRA, Grupo Editorial Expansión, STPS, SEP, SECOFI, SEDESOL, SRE y ANUIES. Conferencista y expositor en toda la República Mexicana y en diversos países de América, Europa y Africa. Editorialista de la agencia de noticias NOTIMEX y colaborador de infinidad de revistas especializadas en educación y temas de desarrollo social.

CONTACTO CON EL AUTOR DEL ARTÍCULO, Cónsul Adscrito, S. R. E.,Tucson, AZ: 553 South Stone Ave, Tucson AZ 85701. Tel. 520-882-5595 ext. 115. E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

© Copyright 2008 Enlace México Express. Todos los derechos reservados.

SecurityCornerMexico.com Recommended READING: Arizona is a State of the United States of America located in the southwestern region of that country. More, HERE by Wikipedia.

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

Assessing Mexican Immigrants Contributions to Arizona´s Economy and Society

Bernardo Mendez Lugo is an Editorial Contributor to Security Corner in Mexico

Member of the Mexican Foreign Service

This study´s data was compiled mainly from US sources that provide facts of the contributions, benefits and support of immigrants (including undocumented) in general to Arizona’s economy. Additionally immigrant´s contribution trends as workers, taxpayers, consumers are valid for the United States and beyond to any host country of immigrants in the World.

Contributions of immigrants are far higher in a clear and conclusive analysis than the sum of all costs that they incurr on as are: public services, education, health services, including deportation proceedings, detention centers and deportation paying carriers.

Also included in this study is a brief analysis of the "pay day loans" industry in Arizona and its lucrative business with immigrants, mostly Mexicans. Hundreds of local pawnbroker industry dealers whose days are numbered as the November state election of 2008 passed an initiative that will not allow this type of business in the near future.

The issue of costs of undocumented immigrants is quite controversial and is generally biased, manipulated by the media, politicians and pseudo-academics who feed their agendas with half trues, myths and arguments that do not have real facts or are not based on real events and official US statistics or use ideological manipulation of US government numbers. Example of this case: www.cis.org

Even academic research centers that claim scientific objectivity in their findings and studies report frecuently distinctly anti-immigrant proposals, with ideological manipulation of statistical figures that do not correspond to a rigorous analysis of the social and economic reality of immigrants without legal papers but that are fully integrated into the economy and society of the United States. This is the case of nearly 13 Million undocumented people in the US, most of them fully integrated to low wage jobs or activities in the informal sector.

Officially, there are in the United States more than twelve million people without immigration status, corresponding to Mexico, seven million of those immigrants, almost half of them in California.

Through this essay´s data and statistics of official collections, one may conclude that the contributions of Mexican immigrants and in general of all immigrants, are key to the local, state and federal treasury coffers as well as the Social Security Administration and for the Internal Revenue Service (IRS its English acronym) for domestic market growth of all types, from immediate consumer goods to consumer durables, including cars, appliances for homes and businesses as well as the real estate industry. Enlaces: www.ssa.gov and www.irs.org

A separate large myth is clearly contradicted by studies on crime rates among immigrants, whether legal or undocumented, compared with US born population. Studies show conclusively that crime rates, violent robberies, homicides and serious crimes are generally lower among recent immigrants or illegal aliens against the indicators of US citizens born on American soil.

A Booming Economy: welcome immigrants. Economy in crisis: go away

Many sectors of Arizona's economy can survive and in many cases compete regionally, nationally and internationally through the work of hundreds of thousands of new immigrants, including a not insignificant number of undocumented Mexicans working in almost all spheres as their performance is vital to the economy of many state regions. Arizona, a state that borders with Sonora, annually hosts a significant number of immigrants from Sonora and secondly, immigrants from the state of Sinaloa.

It is important to distinguish the differences among various segments of the population with Mexican blood in Arizona. Identity is very different between recent immigrants, the undocumented immigrants with several years living and working in Arizona, the immigrants that have a visa to reside but do not have work permit, permanent resident immigrants, the immigrant who has become citizen and nonimmigrant who was born in the United States of Mexican origin, which is rooted in the territory for several generations and therefore Arizonan American by birth. Although these segments bear economic, family, cultural and linguistic ties with Mexico, their behavior and links to Mexico have qualitative differences and their attachment to life and society Arizonan.

Arizona has experienced a dramatic growth of foreign-born population that has been established in the state. In 1990 there were 268,700 people in Arizona that were born abroad, by 2004 the population growth of immigrants came to 830,900 people and is very likely that by late 2010 there will be more than a million immigrants living in Arizona. According to statistics from the Pew Hispanic Center in 2006, there were 926,000 immigrants in the state of Arizona, the vast majority of these immigrants were in the category of non-citizens, from 163,300 in 1990 rose to 619, 800 people in 2004. It is worth to mention that during 2008-2009, tens of thousands of Mexicans left Arizona due to the economic turn down and lack of work, and in some cases due to the discriminatory policies against immigrants. Website of the Pew Hispanic Center: www.pewhispanic.org

The contribution that legal and undocumented Mexicans made to the Arizona state government, via taxes, exceeded 800 million dollars in 2007, according to private estimates. In that year, the purchasing power of this group was 6 thousand 630 million dollars, one of the highest per capita for Mexican communities in the US, according to a study carried out by the University of Thunderbird in Arizona.

The figures are a common example in different states of the country, and a fundamental part of the ongoing immigration debate, where most often the emphasis is placed on the cost of migration to the states.

An increase of more than 30 percent over 2002, when revenues totaled 600 million. In this year, the cost of public services to Mexican migrants totaled $ 281 million, meaning that the public funds of Arizona had a net profit of $ 319 million. The Thunderbird University study highlighted that of all Mexican immigrants in the state, nearly 53.5 percent lacked health insurance and 34 percent used public assistance in 2002. Website of Thunderbird University: www.thunderbird.edu

The analysis does not include the cost to the state of detention of immigrants, or costs local police resources deployed to combat crimes related to illegal migration. Detractors argue that Thunderbird University analysis minimizes the true cost that represents Arizona's economy illegal immigration, for free education only in the state invests $ 187 million annually.

Thunderbird argues that according to 2000 statistics, the latest year for which its final statement had official data, Arizona had 369 thousand 296 Mexican immigrant workers, 18 percent of the workforce. In calculating undocumented labor force integrated to economic activities, there were estimated 114,596 workers, of which nearly 24 % worked in manufacturing, 21% in comercial firms and services and 18 % in construction.

Arizona State University in Tempe.

Purchasing power of Mexican immigrants in Arizona

Another study by the University of Georgia, presents an overview of Mexican immigration from the consumption perspective, legal or undocumented immigrants as clients. This study pointed out that in 2002, their purchasing power in Arizona was 4.2 billion dollars and projected an increase to 6.6 billion dollars for 2003. Very likely for 2010 even with the slow down of the economy in recent years, the undocumented purchasing power may arrive to nearly 10 billion dollars.

Arizona is the state of the United States where most illegal immigrants from Mexico and Central America come into US territory and also has the fourth largest Mexican population in the country, according to U.S. Census Bureau. However, US Immigration officials as once Doris Meissner stated “most undocumented people in the US came with a tourist visa through international US entry ports and overstayed”. Statement of Doris Meissner: www.globalsecurity.org/.../040126-meissner.htm

It is worth noting that the consumption of goods and services of all housing units in Arizona naturalized immigrants reached 6 thousand 600 million dollars which is equivalent to 38,500 full-time jobs, contributing 5 thousand 900 million in income in the state economy, this income includes twelve hundred million dollars in wages over $ 900 million in royalties, dividends and corporate profits.

Consumption expenditure of non-citizen immigrants in 2004 reached 4 thousand 410 million dollars which is equivalent to 28 thousand jobs full-time and contributed 4 thousand 300 million dollars in state product, which includes a total wage $ 926 million and 562.7 million dollars in royalties, dividends and corporate profits. In the area of tax payments by immigrants, naturalized immigrants paid 456.4 million dollars in total tax burden is divided between 48.7 million personal income tax, 213.7 million in excise taxes and $ 194 million of unlimited tax business.

In the case of non-citizen immigrants in Arizona, they paid a total of 318.6 million dollars in taxes, which included 36.5 million personal income tax, of $ 148.3 million of tax and 133.8 million business tax. It must be noted that of all citizens and non-immigrants the percentage of Mexican or Mexican origin is conservatively between 60 and 80% of all immigrants, but in the case of noncitizen immigrants than immigrants citizens.

Buying power of Hispanics in Arizona

Hispanic market in Arizona has over 80% of Mexican consumers or US Citizens of Mexican origin, which in 2007 reached just over 21 billion dollars of purchasing power and it is estimated that in 2009 reached US 31 billion dollars. Arizona is the ninth largest Hispanic market in the US according to 2006 data estimates an annual survey compiled by the Hispanic Chamber of Commerce based in Phoenix, Arizona State University and Salt River Project. Hispanics are a quarter of Arizona's population, totaling 1.6 million Latinos, of whom approximately half a million are immigrants, mostly from Mexico. Arizona State University Hispanic Research Center: www.asu.edu/clas/hrc/

It is important to note that Latino consumers spend more on average than non-Latino consumers in many consumer categories, like groceries and clothing for children.

Some marketing executives in Arizona indicate that some of the strong growth areas (hot growth areas) are where Latinos are consumers of health care services, residential housing, financial services and products, arts and culture.And most of them pay for these services

Additionally, the picture that emerges of Hispanics or Latinos in recent studies in the growing Latino population sample profiles are radically different from most of the non-Latinos. For example, Latinos shift from Spanish to English usage with each generation. Towards the third generation, English dominates in 75% of Latinos in Arizona who speak only English or are bilingual. The new statistics show changes that destroy the old stereotypes of Latinos, and demonstrates the growing influence of Latinos in the growth of business in Arizona through their buying power together.

The statistics also show that Latinos are engaged and well integrated in all Arizona communities rather than segregated or separated into neighborhoods by language, geography, or economic profile. The reality today is that when talking about any aspect of society in Arizona - are business, politics, education, health care - you can not do more, regardless of the Hispanic market and its influence.

The Arizona Latino market has changed dramatically over the past two decades. This shift has been influenced by the following factors:

- Immigration from other countries, particularly Mexico and Central America

- Average age in the Latino population is lower than other segments of the population and Latinos also have high birth rates

- A revenue growth of Latinos due to higher levels of education and training, including the largest English language proficiency

- The continuous process of acculturation and assimilation of successive generations of Latinos

Mexican tourists spending in Arizona

The above figures do not include shipping and tax payments of Mexican visitors who come to shop in southern Arizona. In 2001 these expenditures totaled $ 963 million with a multiplier effect which reached more $ 1.6 billion dollars per year between 2002 and 2008. Most Mexican visitors are from the state of Sonora and 86% of expenditures were made in Pima County (Tucson), Santa Cruz (region of Nogales, Az), Yuma and Cochise, that are Arizona border counties with Sonora, Mexico.

The expenses incurred by Mexican tourists in Arizona in 2001 generated approximately 35 thousand 200 jobs, equivalent to 10% of the total jobs generated by tourism. It is worth noting that total tourist expenditure in Mexico of Arizonans that year was 328 million. Although no official figures from the Mexican tourist expenditures in 2007 or after 2001, you can calculate a minimum growth of 10 to 15% annually, which would mean an approximate expenditure of 1.6 billon dollars annually in 2007 by Mexican tourists in Arizona, which would give a cumulative expenditure of 10 billion dollars in the period 2000-2007.

In a survey conducted by Dr. Alberta Charney in 2001 found that 72% of Mexican respondents who came to Arizona for the main ports of entry by land and air, their main reason for coming was shopping trip, followed by 14% for work and 8 percent for family visits. The $ 41% of the purchases took place in department stores and 25% in supermarkets. Updated research for 2007-2008 shows increasing role of Sonoran Tourists in shopping Malls in Arizona despite the economic recession in Mexico and USA.

The neighboring state of Sonora continues to be the main origin of Mexican visitors to Arizona, with almost 99 percent of all visitors to Mexico from that state. The three largest border communities of Agua Prieta, Nogales, and San Luis RC contribute 93 percent of all Mexican visitors, a percentage almost identical to that in 2001.

The only noticeable change regarding the origin of visitors is among visitors to metro Phoenix. Because more visitors entering through the six southern BPOE are traveling to metro Phoenix, the portion of visitor parties to metro Phoenix from Sonora has increased from 52 percent in 2001 to almost 90 percent in 2007-08. Previously, in 2001, proportionately more metro Phoenix visitors came by air from other Mexican states.

Shopping is the Main Reason for Visiting

Shopping is the main reason for visiting Arizona, with 57.44 percent of all visitor parties listing that as a reason. Visiting friends and relatives, listed by 5.81 percent of all visitor parties as the primary reason for visiting, was also a very strong reason for visiting Arizona. These two portions are down somewhat since 2001 because the portion identified as coming for other business and/or work is higher (35.19 percent in 2007-08 vs. 14.41 percent in 2001). It is not believed that the portion of crossers who come for work has increased since 2001.

Rather, a different survey question (previously in 2001, visitors were asked to list and prioritize two reasons for visiting) and a stronger focus on identifying crossers who worked, resulted in higher proportions in the business/other (including work) category than in 2001, which, in turn reduced the estimated percent that came primarily to shop and visit friends.

For some ports, shopping was listed by a very high portion of visitors as a primary reason. In particular, shopping was identified as the primary reason by shoppers who crossed into Douglas and what we refer to as the “pass-through” ports of Naco, Lukeville and Sasabe, by 79.42, 69.19, 80.09, and 76.47 percent, respectively. Shopping (40.75 percent), followed by visits to friends/relatives (27.59 percent), were the primary reasons for visiting by air travelers.

In addition, air travelers attended conventions/conferences (15.75 percent), received business training (6.25 percent). Overall, very few came for what they describe as a vacation (0.24 percent), personal health reasons (0.14 percent), other personal (0.31 percent), business convention (0.05 percent), business training (0.03) percent. In conclusion, this study has attempted to quantify the economic aspects of Mexican visitors to Arizona.

Each day, more than 65,000 Mexican residents came to Arizona to work, visit friends and relatives, and shop. Each day, they spend over $7,350,000 in Arizona’s stores, restaurants, hotels and other businesses, and thus contribute substantially to Arizona’s export trade with Mexico. Familial ties, long-term friendships, work opportunities and shopping experiences not yet available in Mexico continue to support strong cross-border interactions between Arizona and its neighbor, Sonora. Source: MEXICAN VISITORS TO ARIZONA: VISITOR CHARACTERISTICS AND ECONOMIC IMPACTS, 2007-08 by Vera Pavlakovich-Kochi, PhD and Alberta H. Charney, PhD Economic and Business Research Center, Eller Business School, Universitry of Arizona 2009

Arizona employment has positive impact by exports to Mexico

Another relevant aspect of the benefits for Arizona's economy of its relationship with Mexico is the 17 thousand 69 direct jobs were created in 2001 in Arizona thanks to products exported to Mexico. Economists at the University of Arizona study cited on the Economic Impact of the Mexico-Arizona Relationship (published in May 2003) indicated that about 50 thousand jobs in Arizona are linked to exports to Mexico. Many of these exports are related to the activity of Sonora's maquiladora industry which employed 90.250 workers in the 282 maquiladoras in Sonora, 88 of these plants were located in Nogales and 32 in Agua Prieta. This explains why a little over 80% of Arizona's exports are concentrated in the state of Sonora.

Job loss in the Mexican maquiladora export industry in the period 2001 to 2003 was explained by factors that go beyond the U.S. recession and competition from China, as the new magnet for the maquiladora industry. The recession in US industrial production explained 40% of lost jobs and the Chinese competition around 25 to 30% of this loss, and other external and internal factors justified from 30 to 35% of additional lost jobs, according to the study of J Canas, R. Coronado and B Gilmer, "Maquiladora Downturn: Structural Change or Cyclical Factors?" Business Frontier, num. 2, 2004, quoted in Jorge Carrillo, "The Maquiladora Industry in Mexico": evolution or exhaustion? "In Revista Comercio Exterior, August 2007, p. 681

However, by late 2008 it was perceived that the choice of China as a destination for maquiladoras had declined due to increased cost of labor and increased transportation costs related among other things to security issues. The development of this trend can attract more maquiladora industry in Mexico coupled with significant devaluation of the peso in recent years.

These positive prospects are special representatives in the region-Mexico border but the recessionary trend in U.S. consumption and impact of lower demand for all types of manufactured goods. Another problem for some Mexican border cities is the perception that there is uncertainty due to infighting among the cartels and the frontal undertaken by the federal government of Mexico against the power of drug trafficking.

This climate affects cities like Nuevo Laredo, Ciudad Juarez and Tijuana. This scenario would favor the displacement of part of the maquiladoras to more cities from the border that have good infrastructure, good supply of skilled human resources and a social climate of increased security.

More Mexicans remittances mean more profits for Arizona

In the area of remittances, studies have shown that recent immigrants and undocumented workers channel between 40 and 60% of their salary in remittances to relatives in Mexico Mexican unlike the permanent resident that channels between 10 and 15% of their wages to send money to relatives in Mexico.

For legal permanent residents and those Mexicans who have become naturalized US citizens there are other ways of channeling money and investment to Mexico through the opening of business, housing construction and purchase of real estate operations, which also perform undocumented Mexican immigrants in smaller scale. It is undeniable that recessionary tendencies in the past 18 months affected remittances to Mexico and other Latin American countries.

The high dependency of many regions of Mexico to the dollar remittances sent from the United States is significantly affecting the welfare of thousands of families and the Mexican domestic market in a context of more expensive food and lack of self-sufficiency. If we calculate that the contribution of undocumented workers in Arizona is close to 30 billion dollars of state product according to the study by Dr. Gans of the University of Arizona.

Regarding remittances, these may estimated according to the study "The Economic Impact of the Mexico-Arizona Relationship" conducted by The American Graduate School of International Management from Thunderbird (published May 2003) which in 2002 sent 490 million dollars in remittances to Mexico leaving the State of Arizona earnings of $ 57.9 million for costs of those items. For 2010, these numbers may be close to one billion dollars of remittances sent to Mexico per year.

However, it was estimated that remittances may have reached one billion dollars by the end of 2007, (2008 closed with a slight decline in shipments and amount). The earnings that remain in Arizona only for payments for shipments, would be little more than $ 100 million a year. These figures are consistent with estimates of annual costs at around U.S. estimated at 2 billion dollars that is 10% of total shipments of about 24 billion dollars annually in 2007, only considering shipments to Mexico.

Even considering that in recent years has lowered the cost of transfer through the role of banks and their electronic systems withdrawal card in Mexico and a better exchange rate for bank customer, thanks to the matricula consular has become account holder and access to electronic transfers.

The Arizona Hispanic population and immigrants in 2006

According to census statistics and Study "Arizona: Population and Labor Force Characteristics 2000-2006" published on 23 January 2008 by the Pew Hispanic Center, Arizona had a population of 6.2 million people in 2006. This figure includes 1.8 million Hispanic population. Therefore, the Hispanic population accounted for 29.1% of the total population of Arizona, equivalent to about twice their percentage in the total U.S. Hispanic population (14.8%). Also lived in Arizona in 2006, 926 thousand people born abroad. Which meant 15% of the state's population, a little percentage of immigrants nationwide that was a bit more than 12.5% of the U.S. population.

Importantly, Latin or Hispanic population in Arizona in 2006 was by 1.1 million people born in the United States and 666 thousand immigrants born abroad. Therefore, the 37.0% of the Hispanic population in Arizona in 2006 consisted of foreign-born immigrants, a percentage slightly lower than the proportion of immigrants across the United States was 39.9%. However, Latino immigrants represented 10.8% of the total population of Arizona, nearly double the percentage of Latino immigrants at the national level was 5.9%.

The Arizona Hispanic immigrants accounted for 71.9% of the total immigrant population resident in the state, a proportion much higher than the percentage of Hispanics (47.2%) in the total immigrant population in the United States. Most foreign-born Hispanics arrived in Arizona recently. About one-third, -217.000 to 666.000-arrived between 2000 and 2006. Another third (231 thousand) came between 1990 and 1999. These figures for Arizona not differ significantly from national rates since 60% of all Latino immigrants in the United States arrived after 1990.

Assessment of the weight and actual proportion of the immigrant population of Mexican origin in the Arizona workforce is critical to measure the economic impact of the absence of immigrant workers terrorized by various laws (but especially by HB 2779 that punish employers who hire undocumented workers from 1 January 2008) have decided to return to Mexico or seek alternative employment in other United States states.

The impact of the 2779 Act has been less visible statistically since its entry into force on 1 January 2007 and no can be evaluated by the number of employers punished. The biggest impact has been felt since before its enforcement. Many employers and employees fearful, have decided to change their attitudes and hiring practices.

Many employers have decided to fire their undocumented workers as the workers concerned have decided in many cases, leave their jobs on their own initiative, motivated in part by keeping your records "clean" with the immigration authority and be expected as apply the law and the practicalities of the same criteria to decide their eventual return. Gans noted that "has had a chilling effect," citing anecdotal reports of illegal immigrants leaving the state for fear of the law. "It makes people worry about possible legal action against them."

The study, entitled "Economics and Arizona Law for Legal Workers," is part of Project Economics and Public Policy sponsored by the Institute of Communications (Communications Institute) and the Foundation Thomas R. Brown. Professor Judith Gans emphasized that the study aims to provide an impact analysis of the law and it is too early to draw definitive conclusions.

In fact since mid 2007 until late December 2009, in the daily paperwork carried out by the Consulate of Mexico in Tucson it has been clear that a good percentage of families, particularly those from Sonora and Sinaloa, have decided to return to their places of origin and have requested a greater number of educational transfer papers in the area of the Institute for Mexicans Abroad (IME) for their children returning with them to Mexico and need further study (increased over 100% in 2007 and 2008 compared to 2006).

Also increased the demand of paper work for household goods for Mexican familias, a service provided by the Consulates of Mexico to Mexican citizens returning definitively to Mexico and can prove that they have lived at least two years in the U.S.

Another service that has seen an upswing in demand is the civil registration for Mexican birth certificates for children and young people born here whose parents in many cases are undocumented or tourist visa holders or laser border crossing card and have decided to return to Mexico.

Another indicator not related to the services of the consulate, is the information from the local media in Tucson and Phoenix on the increase in vacant apartments, the vacancy rate was on average 5% by 2007 and it arrived during 2009 to rates between 25% and even 50% of apartments that were not rented in the Tucson region.

In addition, experiencing a period of national economic recession and lower demand for labor in various sectors, including real estate construction and services that affect the lower demand for immigrant workers in this context which combined with new fears given the 2779 Act and reduced labor supply that paralyzed and stagnante precisely the areas of construction, maintenance and laboratory services where a significant percentage of the undocumented are Mexican.

A distinctive feature of the immigrant population in Arizona is much higher than the percentage of immigrants of Mexican origin than the percentage nationwide. In Arizona, the 610 thousand immigrants of Mexican origin in 2006 meant 65.9% of all immigrants in Arizona and 91.7% of Latino immigrants in Arizona. Nationally in 2006 the corresponding percentages were 30.4% and 64.3% respectively.

Economic and social impact of legal harassment against Mexican immigrants in a context of recession in Arizona and the US

The predominance of Mexicans in the immigrant population in Arizona is a significant feature because it might suggest that a significant proportion of its immigrant population is undocumented, compared with rates elsewhere in the country in general agreement with the study by Jeffrey S Passel ( "The Size and Characteristics of the Unauthorized Migrant Population in the U.S.," Pew Hispanic Center, March 7, 2006).

Jeffrey S. Passel estimated that between 80% and 85% of immigrants who arrived in the United States between 1995 and 2005 are illegal or "unauthorized" ( "unauthorized" is the term used by J. Passel in their studies) and that Therefore, immigrants from Mexico are the majority (56%) of the undocumented population in general, the highest percentage in the case of Arizona for its proximity to Mexico, with this estimate, the Pew Hispanic Center estimates that between 400,000 and 450,000 were undocumented immigrants in Arizona in 2005, which means that the total immigrant population, between 45% and 48.0% and between 6.9% and 7.7% of its total population, respectively, are undocumented.

These percentages are considerably higher than Passel estimated as percentage of immigrants nationwide of all immigrants (30.6%) and (3.8%) of total United States population that is undocumented. This greater relative weight of the undocumented in Arizona means that the impact of their absence in the workforce will be much higher than in similar settings in other states.

It should also be taken into consideration that the weight of this segment as consumers of goods and services and their relative impact on housing demand. It is likely that the current recessionary trend in Arizona is more profound than in other states because the costs of various services such as construction, hotels, restaurants and manufacturing will have a tendency to grow, with limited availability of labor and pressure for higher wages that would lead to less competitiveness of these sectors and hence a negative effect that impacts the entire chain of production and services.

The other further impact that can only be evaluated in the medium term is the future impact on the Arizona workforce due to returning youth and children to Mexico. This means children of undocumented workers that return to Mexico because they can not remain without their parents in Arizona despite being US citizens.

The age distribution of Anglo Arizona born population, Hispanic and Hispanic immigrants are very different from one another. Nearly half of Latino children born in Arizona (47.4%) are less than 16 years. Source: Pew Hispanic Center January 23, 2008 Arizona: Population and Labor Force Characteristics 2000-2006.

This contrasts with Latino immigrant children that are only 9.4% of the Hispanic immigrant population and 23% of the general population of Arizona. There were 1.4 million children under 16 years in Arizona in 2006. Of that number, 599.000, or 41.7% were Hispanic, the vast majority born in the U.S. A conservative estimate of a return to Mexico or possibly relocating to another state of 10 to 15% of undocumented families, would be a minimum of 10 to 20% of children under 16 who would follow their parents, which could affect the availability of future workforce in Arizona.

Another indicator that should be assessed more carefully is that almost 70% of Hispanic immigrants in Arizona are aged between 25 and 64 years of age, mostly in highly productive periods as workers compared to only 51.4% in Arizona's total population in this productive life period.

Downtown Phoenix

Significant demographic changes in Arizona since 2000

The growth of Arizona's population between 2000 and 2006 was much higher than the U.S. national average. Overall, Arizona's population increased from 5.1 million in 2000 to 6.2 million in 2006, which means a growth of 20.1% over a period of six years, this growth was considerably higher than the average population increase to national level was 6.4% over the same period.

Drop in remittances in 2007 and first half of 2008 in 11 states of Mexico: 2008 closed with a fall of over two billion dollars.

According to information released by The Bank of Mexico in the newspaper El Universal in Mexico City, on 4 February 2008, eleven states in Mexico registered a drop in attracting remittances from overseas Mexicans, mainly thiose working in the USA. Michoacan, Jalisco and Mexico City were the Mexican region that had increased remittances in 2006 but in 2007 and 2008, there was a visible contraction of resources sent to these three regions.

In addition, Aguascalientes, Campeche, Chiapas, Chihuahua, Querétaro, Quintana Roo, Sonora and Tabasco in 2007 had fewer remittances from migrants from these states and that reside in the US, compared with a year ago. During 2006, the only entity which saw a decline in the inflow of remittances was a year ago against Michoacan.

An important piece in the puzzle of remittances sent to Mexico in 2007 was the Federal District in a year rose from fifth to seventh position, while being displaced by Puebla and Veracruz. The registered capital of the Republic in 2007, a drop of $ 167 million compared to 2006. In the "family remittances income distributed by State" for 2007, presented by the Bank of Mexico, despite shrinking resources of 6%, Michoacán continued as the largest recipient with 2 thousand 263 million dollars for 2007.

Guanajuato had the second place in 2007 with 2 thousand 143 million dollars of remittances, greater than 2 thousand 100 million dollars recorded in 2006. In the third seat for the first time surpassing the 2 billion dollars, ranked the state of Mexico with a total amount of 2 thousand 23 million dollars, against 1.993 million dollars in 2006.

Fourth place in 2007 in attracting remittances went to Jalisco thato received 1.937 million US dollars, lower than the 1.957 million dollars in 2006.

For the first time in a quantitative assessment, Puebla reached number five as Mexican state source of US dollars remittances. Puebla Migrants sent to relatives poblanos 1.495 million dollars, a figure higher than the 8% recorded in 2006. In sixth place was positioned Veracruz, Mexican state that reached 1.473 million dollars, a figure greater than 1,435 million dollars from the same level in 2006. The seventh seat down was Mexico City that captured last year 1, 372 US million dollars, versus $ 1.539 million received in 2006. According to the Bank of Mexico, remittances in 2007 showed a total amount of 23 thousand 979 million dollars.

Jose Arteaga, a Mexican that failed to enter to the US, said that "Mexicans that travel to the U.S. in search of a better future are not welcome and have faced increased security measures at the border and work restrictions”

Remittance costs and high-cost loans in Arizona

A financial fact linked to relatively high cost of remittances is the fact that there are high costs for millions of workers who do not have bank accounts and cash checks that need their wages in businesses that charge high fees for cashing their check or receiving loan checks on their future in chains such as Pay Day Loans, Check & Go, CheckSmart, CheckAdvance, pawn businesses and dozens of firms with several basic banking services.

According to an article published on 24 January 2008 in the Wall Street Journal by former President Bill Clinton and Arnold Schwarzenegger, California governor point out that "the market for basic financial services is in great swing. Today, the number of companies cashing checks, lenders offer loans in advance of future employee check cashing and pawn companies receiving vehicle titles amount to more than double the total of McDonald's franchises in the U.S. "

Clinton and Schwarzenegger indicate that "more than 20 million Americans charged more than 60 billion dollars annually from their paychecks in this kind of business with unfair tariffs and predatory. Full-time workers who have no bank account pay on average $ 40 to cash their checks from work.

In addition, these companies pay for "immediate" sell 40 billion additional dollars annually predatory small loans which require the debtor interest rates up to 30 times higher than average rates of a credit card. A worker who has no bank account and make payments by check-cashers and predatory lending, spends about 8 billion dollars annually in fees and interest payments.

Considering the increasing number of such establishments in Arizona and its leadership at the national level (in www.mypaydaycashadvanceloans.com site is a directory of these businesses, there is a list of 667 establishments in the state of Arizona) for the small amount of checks and loans in Arizona, far exceeding the second competitor is the state of California, one can deduce that a significant segment of business customers of these high-cost predatory and the Mexican worker is undocumented and in general many U.S. regions, and therefore would not be surprising that the 20 million Americans who use this type of financial services expensive, at least 15% are undocumented Mexican workers, or 3 million workers who would be paying 1,200 million dollars in commissions and interest.

Arizona´s National leadership in the amount of cash loans in advance (Payday Loans) and the key role of undocumented Mexican customers as "captive" users of these loans.

According to a note by the Tucson Citizen newspaper of January 29, 2008 signed by Jeremy Thomas of Cronkite News Service, Arizona has an undisputed national leadership in the amount of cash loans advanced (pay day loans or unsecured cash loans) under sources cited by the Office of the United States Census. Also there's first national car rental van or truck type and in the manufacture of concrete blocks, bricks and cement and rod structures (trusses) used in the construction industry.

Observers of the state economy indicated that these data reflect a state of constant movement. These indicators derived from the last economic census conducted in 2002 and comes out every five years.

Questionnaires for 2007 have already been sent to the business but available results are not taken until at least late 2008. Arizona has a large advantage and national leadership in "unsecured cash loans (unsecured cash loans), a category which comprises establishments primarily developed for cash loans, known in English as" payday loans ".

In Arizona, these businesses reported in 2002 revenue by 4.7 billion dollars, far ahead of second place occupied by California with a total of almost 3 billion dollars. This difference in California with a population six times larger than Arizona (37.7 million in 2007 and Arizona a little over 6.2 million in 2006) may have several explanations, one that Arizona has a high proportion of people without bank accounts, many of them undocumented and temporary workers with high mobility and job rotation within the state.

The hypothesis could explain the fact that California has nearly five times more illegal immigrants but less relevance compared to Arizona, in number of pay day loans business and check cashing fast loans, very likely because in California there has been greater “bankarization” among the undocumented due to the fact of the promotion and involvement of many banks to open accounts regardless of immigration status of the client and in the case of Arizona there has been a climate of hostility and rejection of the immigrant as perceived in this state, a situation that frightens and influences immigrants in Arizona, who prefer to limit their outings and public activities.

"The data in question, I see the lack of banking practices due to high labor mobility, as a result of being a state of rapid growth," said Tracy Clark, an economist with the Center for Economic Analysis at JPMorgan Chase Arizona State University Center at Arizona State University in the WP Carey School of Business. Such activities are sued by people who can not establish permanent relations with a bank. "

In our opinion, people who can not establish bank accounts are not necessarily the American workers with labor mobility because regardless of where they are, there are no barriers to open a bank account, make deposits, use credit card or automatic withdrawal card debit. The same is true of legal residents or farm workers with labor permits who would not have obstacles to have a bank account except perhaps for agricultural workers with temporary visas who are in isolated regions.

Our hypothesis is that a high percentage of workers without banking services access are undocumented Mexican migrants who do not meet the requirements to open an account even though the matricula consular is accepted in most banks. It is possible that agricultural worker isolation and fear of illegal immigrants residing in urban areas do not allow immigrants to establish bank accounts, rely on these establishments to cash a check, send money, borrow on their future cash checks.

Calculations indicate that 30% of people in America who have no bank account ("unbanked") or with expensive financial services or incomplete banking services ("underbanked") are Hispanic, ie between 10 and 15 million people total domestic consumers in this situation. We can make a rough quantification of the Mexican undocumented or laborers under temporary work permits that could be part of this number of people without bank accounts or with poor financial services and is likely that Mexican national segment is between 3 and 5 million workers, 3 million without bank accounts and at least 2 million with high-cost financial services.

In the case of Arizona, Carolina Reid, economist at the Federal Reserve Bank of San Francisco, California wrote a paper entitled "Reaching the unbanked Market: Innovative Strategies to Help Families Achieve Financial Security in Arizona" presented at Arizona CRA Banker's Roundtable in Tucson on 11 August 2006) which cites a study by the Center for Economic Integrity of the Southwest 2003 which documented the growth of establishments in fast cash loans in Pima County and its negative impact in low-income residents, considering that the Pima County residents pay $ 20 million annually in fees and charges only these establishments.

According to Reid in her paper (page 10) in the case of the "unbanked" in Phoenix distribution in the type of neighborhood is mixed but in the case of Tucson's map the "unbanked" coincides closely with the neighborhoods and urban spaces where Mexican immigrants reside and points out that the high percentage of Mexican immigrants in Arizona suggests the existence of a large market of unbanked poor or financial services or "underbanked."

Tracy Clark, economist already mentioned, noted that "Arizona residents tend to move frequently, which explains the state to lead in per capita income of vans, trucks and recreational vehicles. Moving truck companies like U-Haul had revenues of over $ 600 million in 2002, which means about $ 113 per resident. "Our migration moves in and out of state," said Marshall Vest, an economist at the Eller College of Business at the University of Arizona. "We had a rapid growth, booming construction and indicators are indicative of that."

Indicators show that Arizona's economy is more dependent on the construction industry than most other places in the nation. Arizona took first place in the manufacture of foundation (truss manufacturing) and manufacturing concrete block and brick per capita in 2002. The building foundations or structures accounted for $ 223 million in revenue and blocks and bricks were worth 183 million dollars, all based on the mentioned 2002 Economic Census.

This growth was due to the growth indicators of construction (construction boom), which analysts agree is not feasible to repeat the economic census for 2007 because the statistics correspond to the collapse of the housing market year. The fall in overall economic activity will affect other sectors such as restaurants and consumer spending because there will be less money available to spend.

Arizona Demographics data estimates that approximately half a million undocumented persons live in the state, that one-sixth are minor and approximate of 20-25% of undocumented women do not work, it is estimated that Mexican workers active, both men and women in Arizona may be between 250 to 300 thousand people, considering that a certain percentage of children are in the labor force and an unknown number of women engaged in informal work are difficult to quantify monetarily.

Calculating that the total remittances of Mexicans working in Arizona in 2007 could approach one billion dollars, is not unreasonable to think that the shipping charges and commissions for quick loans exceeds $ 120 million annually when adding excessive costs of change checks and predatory lending in this booming industry of check-cashing businesses mentioned above.

Taking into account the calculation that Caroline Reid does in her study of the average annual cost of $ 800 (page 6 of the study quoted) for families who regularly use the services of check cashing establishments, remittances and payment of utility bills (utilities bills) for Arizona only 200 thousand workers cntand immigrants with their families using these services would have an annual expenditure of approximately $ 160 million.

Taking into consideration that the payment of taxes in Arizona of Mexican immigrants amounted to a total of 379.5 million dollars in 2002 and it was estimated that by 2007 would reach 556.1 million dollars in tax payments (amount of income tax and sales) which means an increase of almost 50% in five years, we could estimate that remittances probably approached one billion dollars by the end of 2007, with a low monthly average remittances during 2007 by the recessionary impact of the economy and cost jobs or salaries for the segment of undocumented Mexican migrants.

As noted by the governor of the Bank of Mexico on 31 January 2008 (Mexican daily La Jornada, Mexico City, "a virtual standstill, the amount of remittances in 2007," report by Roberto Gonzalez Amador and Juan Antonio Zuniga) who commented that the poor growth of remittances in 2007 is attributable to several factors, among which mention four: "the slowdown in U.S. economic activity and especially the construction industry, which is an important source of employment for a number high Mexican workers, the biggest problems they have faced to emigrate to the United States to greater border enforcement in that country, the growing difficulties for undocumented migrants to find employment, to official controls more stringent workplace, and phasing in the statistical effect of rising remittances, resulting from the improvement in coverage and measurement of such transactions. " This description fully agrees with the situation of undocumented Mexican workers in Arizona.

Pay Day Loan Centers in South Tucson offer fast money and high fares: Mexicans are the victims ( article by The Independent, University of Arizona Student newspaper)

As the wildflowers after the monsoon, business loans are appearing along the streets of South Tucson. So many, that the city council is seeking to restrict the establishments. "They take advantage of those less fortunate," said John Garcia Citizen Councilor. There are six loan business in South Tucson, roughly one for every 900 residents. Mayor Jennifer Eckstrom said, "This is ridiculous."

According to the Center for Economic Integrity Southwest, 67 percent of the loan centers are a quarter mile of highly poor areas. "These companies are making prey to people who can not afford it," Garcia said. The idea behind the centers is to pay people their wages in advance in case an unexpected bill or a financial emergency arises, however, the most that can be borrowed is $ 500 per pay.

The process, at first glance appears to be simple. All you need is an ID and a blank check. Those borrowing the money should be alert to the fine print. These businesses are known for very high fees. Eileen Sanders, branch manager of Quick Cash at 3313 S. 6th Ave, described as are the rates. In Quick Cash, customers should make a check that includes the fee to have your loan. Customers make their check so they can afford and the loan center takes away 15 per cent. What remains is what the loan is in total

For example, a person needs to do a check for $ 588.24 to make him a loan of $ 500. The 15 percent seems to be a very high rate for some people, but Arizona law allows these businesses charge up to 36 per cent means that the loan center could keep 36 percent of the amount in the check. Once approved the loan, which is also known as a delayed presentation of a check, and payment is going to win, Quick Cash the check is returned to the customer and this makes a check for them. Often it is the 15 percent loan that makes customers coming back. "Please have the number for the day that payment is due, we are left with the check until next payday," said Sanders.

This makes the balance of which will go to borrow a new loan. If a client can not pay the amount due, Quick Cash gets his check and adds another 15 percent interest. This is what binds to many, and makes back each payday. Customers end up paying much more than expected in this center loan / check cashing is one of the centers of loans that the city council will discuss during their meeting on 3 October 2005. Source: By Martin McClarron. Translated by Matt Pepe. Page / Page 2. THE INDEPENDENT September / September 2005. The Independent, UA Journalism Dept. P.O. 210,080 Box Phone: 621-3618 Fax: 621-7557. News Editor: Marcee McKernan. Spanish / Border Editor Joan Gyek

Homeownership for Mexican Immigrants in Arizona

We should note that both documented and undocumented immigrants also make homeownership and business ownership in America. The 2000 US Census, the population are Hispanic or Latino in Arizona that includes Mexicans and other Latin American nations reached a million 300 thousand people, this figure is one million people of Mexican origin population includes ethnic U.S. Mexican-born and immigrants born in Mexico. Of these one million people, 600 thousand born in the U.S. and 464 thousand are immigrants from Mexico, of which 180 thousand are 284 thousand documented and undocumented.

In the study (July 2007), coordinated by Dr. Judith Gans of the University of Arizona indicated that around half a million people are without work permits or without legal authorization in the U.S.. Data on housing occupancy patterns by the Hispanic population indicate that 57% are homeowners and 43% are families who rent housing. http://uanews.org/node/13529

Considering the average value of homes in Arizona, the average cost of monthly income and family size Hispanic immigrants are estimated to spend around 1,500 million dollars annually on mortgages of their homes and rental housing, 800 million related to mortgage payments and $ 700 million payments are rental housing. Another aspect to consider for an overview of the importance of Hispanic residents as a tenant or applicant for rental housing is the fact that Hispanics who are heads of households are less able to buy a house or home ownership than non-Hispanic (56.2% Hispanics compared with 68.3% for all Arizonans).

Reflecting the general trend of economic assimilation, the Hispanic homeownership increases over time of filing in the United States, in particular the home ownership rate increases from 17.9% among Latino immigrants who arrived in 2000 to 72.0% among those who arrived before 1990. Another distinctive feature of Hispanics in Arizona is that it is much more frequent family living in larger families.

About 90.3% lived in homes with their families while the percentage for Arizonans in general was 83.4%. It is also less common for Latinos live in families of two members (only 14.1% while 29.2% of Arizonans are families of two members) and is much more common for Latino families have 5 or more people (43.3%, while only 28.7% of Arizonans are families of this size).

Mexican migrant worker, educational grant from Mexico to U.S. and U.S. economic competitiveness: the case of Arizona

Hundreds of thousands of undocumented workers are an essential factor in economic competitiveness of thousands of Arizona companies in agricultural regions, in activities related to hospitality industry services and construction. In recent years, the dynamic real estate construction and general urban infrastructure firms in many cities of Arizona, benefit from the Mexican laborers

Another relatively recent development in relation to Mexican migrant is the deliberate policy of the U.S. banking system to attract new customers among recent immigrants regardless of legal status and make them participate in the lucrative market for remittance transfers to Mexico. It has not been evaluated or accounted the total amount of new bank accounts opened by illegal immigrants in Arizona and their average balances but a conservative estimate would amount to a state level between 25 and 50 million dollars in new accounts opened between the 2002 and 2007 for illegal immigrants who previously had no access to the banking system.

Economist David Ibarra Muñoz, former secretary of the Treasury and Public Credit of Mexico writes that "altogether, Mexican immigrants make a positive net contribution to the potentially small annual produce huge U.S. and represent about 4% of the workforce in this country. By widening the available workforce, immigration helps to improve the use of capital and other resources of the U.S. economy. However, apart from considerations relating to the preservation of culture and national identity, the main tensions and political contradictions stem from the distributional effects of the phenomenon of migration. Bio of David Ibarra by Wikipedia:

Of course, employers gain the availability of abundant labor, low wages. That's what makes it more competitive costs, either in domestic markets or international ones. In contrast, in proportion, perhaps less, lose native workers to be displaced to some degree or see reduced levels and increases in their remuneration, mainly in the segment of low-skilled occupations. The federal and local treasuries may be beneficiaries or losers depending on whether the taxes paid by migrants are higher or lower than the cost of the services they receive, combined with federal spending on border security. "

David Ibarra’ concepts are generally about Mexican immigration in the United Status but can apply to the specific case of the state of Arizona. It is clear that Arizona has attracted industries, real estate growth and service companies due to undocumented Mexican labor. It is also true that in the native segments with low-scoring Arizonans get some impact on the wage or low wage growth slow due to the presence of undocumented workers who can not push for wages in accordance with the law or seek increased salary.

Miscellaneous information indicates that in the border area is growing migration of technicians and people with more formal education level, not necessarily unemployed in Mexico to work in Arizona in the low-skilled service sector, construction industry or as a minimum-wage workers.

Another phenomenon detected by analysts, is the growing emigration of Mexican and Latino skilled professionals that are in demand-doctors, dentists, nurses, educators in several Arizona cities and towns especially in the cities of Tucson and Phoenix. If you count the cost of education of these migrants to the government of Mexico, especially in the profile of migrants that have more than 9 years of formal education , perhaps half of current migrants, we can speak of an "educational grant" and brain drain from Mexico to the US.

This segment of migrants can be incorporated into semi-skilled or skilled work or they can receive and quickly assimilate training by formal educational background, is a form of subsidy to the US economy is not spent in the training of personnel involved in business and also with "low wage" which means a real benefit to American competitiveness and supporting the stability of inflation with low growth of wages of unskilled staff.

This trend has strengthened over the period 2000-2008 and Mexican professionals increasingly migrate to the US, for the most number for lower skilled jobs, often without proper visas to work. In the case of Mexican migration to Canada is a more recent phenomenon which has manifested itself with greater visibility in the wake of anti-immigrant laws in Arizona and other US states and pushing Mexican workers to seek new alternatives in Canada also with the added attraction that is relatively more accessible for work visas or permanent residence.

It is not easy to make an overall review of all benefits and contributions of immigrant workers in general to the economy and society of Arizona. In the case of immigrants who have become U.S. citizens who are permanent residents in the United States or have work permits, there are more statistics and quantitative data about their wages, type of activity, household size and details of their behavior as a consumer, credit history, among other indicators, but this information is more difficult to obtain in the case of the undocumented immigrants.

Earnings in the US Social Security and the role of undocumented workers in the generation of these earnings

Immigrant is defined as any person born outside the United States and its territories under their jurisdiction. The complexity of measuring inputs exists when it comes to illegal immigrants and this is due to several reasons, one of them is that a percentage of these immigrants work in the informal sector or self, in formal employment without being declared by their employers, there are also cases of illegal immigrants working under another name, Social Security numbers belonging to other persons or with false documents and Social Security numbers is missing or permanent resident cards that are nonexistent.

According to figures cited in May 2006 by Robert McNatt and Frank Benassi Firm Standard & Poor, the Social Security Office of the United States holds between 6 and 7 billion dollars in an account called "earnings suspense file" and other analysts have called "net income account or net profit account" that are tax monies W-2 that do not fit or match a correct Social Security number.

Analysts cited the vast majority of these numbers are attributable to undocumented workers who can never claim their benefits. Several analysts conclude that this foundation of "profits on hold" in 30 years has accumulated more than 300 billion dollars, most of which could correspond to the contributions of undocumented immigrants to Social Security.

The contributions of Mexican immigrant and bias thinking while speaking of "costs outweigh the benefits"

One factor that affects ideological objective analysis is when the discussion on immigrant contributions and costs to the economy of Arizona and the United States in general, is part of the political-electoral debate and present partial data or characteristics of a region like the border or a particular city where the indicators are not representative of the quantities and quantifications to state and national level.

Arizona, for both factors converge to an underestimation of the contributions and benefits of immigrants in general and especially the undocumented immigrant. There is a tendency of political debate in Arizona that tends to overestimate the costs and expenses incurred in the illegal immigrant. Furthermore, not enough information on the actual number of undocumented workers, how many of those who theoretically have medical and other benefits make use of them.

It tends to emphasize the cost incurred by the Border and in-patient medical care of undocumented immigrants as well as costs in detention centers and jails, legal costs and judicial procedures of the undocumented immigrant. For almost all counties bordering Mexico to California, Arizona, New Mexico and Texas has the tendency to emphasize the costs that the presence of the undocumented and there is any contribution of the undocumented who are active in the force working in the region and the wider U.S. economy, is underestimated and minimized.

A recent study by the University of Arizona indicates that if all workers who are not citizens were eliminated from the workforce in Arizona, the state's gross domestic product would fall by at least 29 billion dollars. This group of immigrants is 8.2% of the workforce, mostly undocumented workers according to the study cited.

This study also indicates that the total labor force immigrants (documented and undocumented) generates about 44 billion dollars in state income. This "income" includes the value of goods produced in industry, wages and profits. The study author Dr. Judith Gans said "I am not taking a position on economic policy we should follow". Judith Gans (bio) is the administrator of a program of the Udall Center for the Study of Public Policy at the University of Arizona.

The study is based on information from the U.S. Census Bureau and other 2004 data, the most recent year which has more complete information. It is assumed in the study that most non-citizens in the state are undocumented immigrants.

The author acknowledged that her research cited does not include all costs associated with undocumented immigrants, but said that it attracted a significant amount of such costs or expenses "is not the purpose of this study to address the many issues and implications surrounding illegal immigration or somehow deduce that illegal immigration is not a problem" said Dr. Gans, author of the study involving funds from the Thomas R. Brown Foundation in Tucson. This foundation provides funding for academic research and promotes education on economic issues.

The results of this study did not come as a surprise to Mr Jack Camper, president and CEO of the Tucson Metropolitan Chamber of Commerce. Mr. Camper emphasized that "Tucson businesses have long known that immigrants are an economic spark plug. The key question is how to have more legal immigrants. "

"These data only speak of the need for a guest worker program," said business leader Camper, adding "we need to somehow fix the situation of 12 million undocumented immigrants to get them out of the shadows." However, organizations that have less academic agendas such as the Center for Immigration Studies (Center for Immigration Studies, CIS by its initials in English), based in Washington, DC, is a group that advocates lower levels of migration, Officials of CIS said -in referring to the study by Dr. Gans- that "these studies do not pay enough attention to basic services costs generated by illegal immigrants to the state of Arizona."

Steven Camarota, research director of the CIS argued that "what happens to the costs of road maintenance, fire and police?" And he argued that "there is some benefit to US-born immigrants who work in the economy but it seems very little benefit but at the expense or detriment of less-educated natives. "